wisconsin auto sales tax rate

The base state sales tax rate in Wisconsin is 5. The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543.

Free Wisconsin Bill Of Sale Forms 4 Pdf Eforms

31 rows The state sales tax rate in Wisconsin is 5000.

. Stats aircraft and truck bodies including semitrailers to nonresidents who do not use the property other than to remove it from Wisconsin are exempt from Wisconsin. Some dealerships also have the option to. Publication 202 517 Printed on Recycled Paper.

Motor Vehicle Sales Leases and Repairs. The state sales tax on a car purchase in Wisconsin is 5. 776 rows Average Sales Tax With Local.

Local tax rates in Wisconsin range from 0 to 06 making the sales tax range in Wisconsin 5 to 56. The sales tax charged on car purchases in Wisconsin is 5 so you can expect to pay at least 5 of the total vehicle price for the tax fee. This lookup does not.

State of Wisconsin. The Wisconsin State Wisconsin sales tax is 500 the same as the Wisconsin state sales tax. Wisconsin has a 5 statewide sales tax rate but also has 99 local tax jurisdictions including cities towns counties and special districts that collect.

Topical and Court Case Index. The Wisconsin Department of Revenue DOR reviews all tax exemptions. In addition there may be county taxes.

With local taxes the total sales tax. You may have to hire an attorney if the department cannot. Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles.

Maximum Possible Sales Tax. Call DOR at 608 266-2776 with any sales tax exemption. While many other states allow counties and other localities to collect a local option sales.

You may use this lookup to determine the Wisconsin state county and baseball stadium district sales tax rates that apply to a location in Wisconsin. 7 rows The statewide sales tax in Wisconsin is 5 which applies to any car purchase new or used. Department of Revenue Sales and Use Tax.

However if a vehicle purchased in another state the District of Columbia or the Commonwealth of Puerto Rico is subject to sales tax in that jurisdiction a credit against. The Wisconsin sales tax is a 5 tax imposed on the sales price of retailers who sell license lease or rent tangible personal property certain coins and stamps. Groceries and prescription drugs are exempt from the Wisconsin sales tax.

If you have questions about how to proceed you can call the department at 608 266-1425. The total tax rate also depends on your county and local taxes which can be as high as 675. Wisconsin Sales and Use Tax I nformation Publication 201.

Baseball stadium tax ended March 31 2020. Wisconsin has state sales tax of 5 and allows. Average Local State Sales Tax.

Therefore you will be required to pay an additional 5 on top of the purchase price of the vehicle. What is the sales tax rate. There are also county taxes of up to 05 and a stadium tax of up to 01.

In Wisconsin the state sales tax rate of 5 applies to all car sales. You may be penalized for fraudulent entries. Maximum Local Sales Tax.

State Sales Tax Rates 2022 Avalara

Wisconsin Dmv Official Government Site Municipal Or County Vehicle Registration Fee Wheel Tax

Wisconsin Estate Tax Everything You Need To Know Smartasset

Understanding California S Sales Tax

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Car Sales Tax In Wyoming Getjerry Com

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

Understanding California S Sales Tax

Wisconsin Estate Tax Everything You Need To Know Smartasset

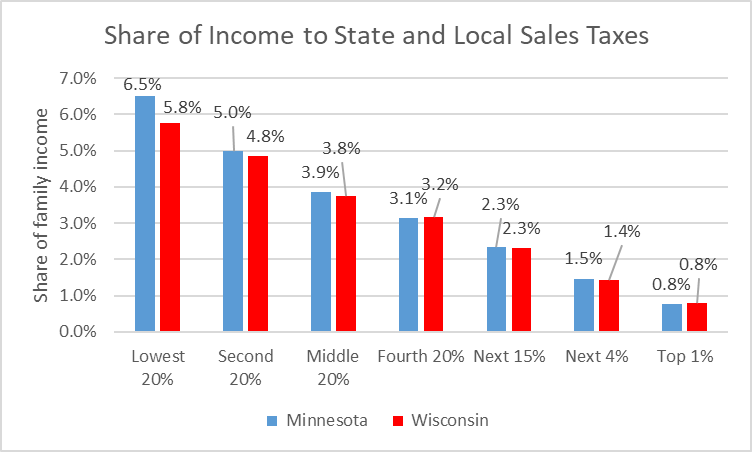

Tax Policy States With The Highest And Lowest Taxes

Sales Tax On Cars And Vehicles In Florida

Wisconsin Car Registration Everything You Need To Know

States With The Highest And Lowest Sales Taxes

What New Car Fees Should You Pay Edmunds

Sales Taxes In The United States Wikiwand

What S The Car Sales Tax In Each State Find The Best Car Price

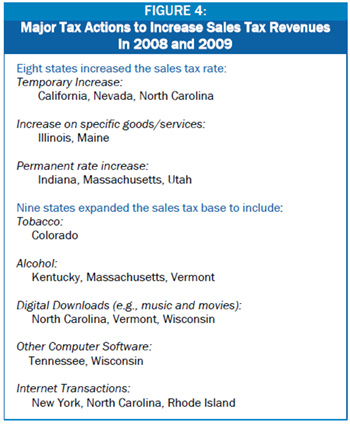

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities